|

|

|

Tithe an Oireachtais An Comhchoiste um Fhiontraíocht agus Mionghnóthaí An Naóú Tuarascáil An Tuarascáil Deiridh maidir le hAthchóirithe ar Mhargadh Árachais na hÉireann Márta 2007 Houses of the Oireachtas Joint Committee on Enterprise and Small Business Ninth Report Final Report on Reforms to the Irish Insurance Market March 2007 CONTENTS

Appendix A Witnesses at Meetings on Insurance Reform with the Joint Committee on Enterprise and Small Business Appendix B Categorisation of Recommendations in the Third Interim and the Road Safety Reports i Chairman’s ForewordThe publication of the Final Report on Insurance Reform by the Joint Committee on Enterprise and Small Business shows the success of the insurance reform programme. The Joint Committee sustained its commitment to the cause of insurance reform over the past four years. Since the publication of our First Interim Report, there have been significant reductions in the level of insurance premiums and improvements in the environment in which insurance companies operate. The Joint Committee expresses its appreciation of the support given by Government Ministers, including Mr Michéal Martin, T.D, the Minister for Enterprise, Trade and Employment, Mr Michael McDowell, T.D., the Minister for Justice, Equality and Law Reform, and Mr Martin Cullen, T.D., the Minister for Transport. We also wish to express our thanks to those in the insurance industry and all of the other persons who made presentations to the Joint Committee during 2006. The Joint Committee also wishes to thank O’Reilly Consultants who assisted the Joint Committee in its evaluation and analysis of the evidence given and the Committee Secretariat for its support throughout this project. In adopting this Final Report, the Joint Committee of the Twenty-ninth Oireachtas has completed its work on insurance reform. The Joint Committee requests that the Joint Committee of the 30th Oireachtas prepares a report in about two years on a number of recommendations that have not yet been implemented. I wish to thank especially all of the Members of the Joint Committee for their support and hard work to ensure that insurance costs in Ireland would be reasonable for consumers and internationally competitive. Donie Cassidy, T.D. Chairman Joint Committee on Enterprise and Small Business 14 March 2007 ii Members of the Joint Committee on Enterprise and Small Business

iii Committee on Enterprise and Small Business Orders of

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year |

Dwellings |

Motor Cycles |

Private Motor Cars |

1997 |

3% |

2% |

3% |

1998 |

2% |

35% |

4% |

1999 |

3% |

22% |

6% |

2000 |

4% |

0% |

9% |

2001 |

10% |

18% |

17% |

2002 |

16% |

38% |

13% |

2003 |

4% |

17% |

-1% |

2004 |

-1% |

15% |

-12% |

2005 |

-5% |

1% |

-10% |

2006 |

-7% |

0% |

-7% |

End 2006 compared to average 2006 |

-4% |

0% |

-4% |

Increases average 2006 compared to average 1996 |

29% |

272% |

20% |

Source: Central Statistics Office (CSO) Special Report: January 2007

Months of Significant Changes

Year |

Dwellings |

Motor Cycles |

Private Motor Cars |

1997 |

|||

1998 |

+May/July/Sept +Oct/Nov/Dec |

||

1999 |

-Aug |

||

2000 |

+Oct/Dec |

+Dec |

|

2001 |

+Feb/Mar +Nov/Dec |

+Sept/Oct/Nov |

+Jan/Mar/Apr +Oct/Nov |

2002 |

+July |

+May/Oct |

|

2003 |

+April |

+Jun -Nov |

-Sept/Oct/Nov |

2004 |

+Feb |

-Sept |

|

2005 |

-Jan/Mar/Aug |

-Nov |

|

2006 |

-Jan/Jun/Sept/ Nov |

-Sept |

Comment

Over the ten years from 1996 to 2006, increases in the costs of insurance have been:

Dwellings: +29%

Motor Cycles: +272%

Motor Cars: +20%

Motor cycle insurance is a small part of the total market. However, the increases have been extraordinary and there have been almost no reductions in costs.

For Dwellings and Private Motor Cars, it is clear that the major increases took place in 2001 and 2002. Costs fell in 2005 and 2006 and were continuing to fall at the end of 2006.

This information is produced by the CSO as part of the Consumer Price Index. There is no similar information available for commercial motor or liability insurance (employer’s liability and public liability) as they are not consumer expenditure.

The increases in the cost of insurance caused a major public outcry. The Joint Committee in its first report reported on the evidence received of the effects of the rapid increases in insurance costs. Appendix B3 from the first report, ‘The Burden on Business – the Case for Change’ is reproduced below.

Businesses have experienced enormous increases in the cost of insurance over the past few years. According to an SFA (Small Firms Association) survey, 92 per cent of businesses regarded insurance costs as a significant business problem. Evidence presented to the Committee in written submissions and during oral hearings has shown the extremely large percentage increases.

The IHF (Irish Hotels Federation) stated that the results of one of its surveys showed that the mean increase in members’ premiums between 2000 and 2003 was 351 per cent. According to the IHF, between 2000 and 2003, excesses on insurance policies have increased by over 2000 per cent. According to the IHF and others, no matter what steps businesses take to manage and reduce risk, there is little or no impact on the premiums charged. This may lead to a situation where businesses no longer see the benefit of striving to eliminate risk.

ISME (Irish Small and Medium Enterprises Association) stated that their members experienced an average increase over the past 2 ½ years of 290 per cent and that businesses spent an average of 2.5 per cent of their turnover on premiums. Approximately 10 per cent, or 350, ISME members are self-insured and a recent article in The Sunday Times indicated that 10,000 Irish businesses were uninsured. As a result of being uninsured, the directors of these companies are personally liable for accidents that occur on their premises. ISME stated that high insurance costs were acting as a barrier to startups and thus stifling wealth creation.

According to SFA, many businesses now have to borrow to pay their insurance premiums.

According to AIR, (Alliance for Insurance Reform) the dramatic rise in insurance costs and the difficulty experienced by many businesses in finding insurance quotes have already forced the closure of a number of businesses and led to a loss of employment. In a recent ISME survey of 1,000 companies, 400 companies stated that they anticipated job losses.

IBEC (Irish Business and Employers Confederation) stated that high insurance premiums had a significant effect on business because:

The Joint Committee discussed the position with the insurance companies in detail and received many submissions outlining the reasons why insurance costs increased so dramatically. In addition, the Competition Authority carried out a wide-ranging study to try to determine the reasons for the rapid increase in insurance premiums.

Arising from the studies undertaken by the Competition Authority and its external consultants, it seemed that there were two main factors that gave rise to the very sharp increase in premiums for employers and public liability insurance.

The explanations given to the Joint Committee by the insurance companies included:

Undoubtedly, the insurance companies were influenced to increase prices by their results over the previous five years.

Underwriting Results of Insurance Companies

Class of Insurance |

Loss Years |

2001 |

2002 |

Private Motor |

1998–2002 |

-€107m |

-€9 m |

Commercial Motor |

1998–2001 |

-€67m |

+€28 m |

Household Property |

1998; 2000–2002 |

-€44m |

-€53 m |

Commercial Property |

1998–2000 |

+€11m |

+€86 m |

Employer’s Liability |

1998–2002 |

*-€55m |

*-€60 m |

Public Liability |

1998–2002 |

*-€100m |

*-€50 m |

It can be seen from the above that the underwriting results (before taking into account income from investments) of the insurance companies were poor, with losses on most classes of insurance each year.

Source: Insurance Industry Federation Fact File on website

The increases in insurance costs gave rise to very considerable Government concern.

The Motor Insurance Advisory Board (MIAB), which had been established in September 1998 under the chair of Ms Dorothea Dowling, published its report on the high costs of motor insurance in April 2002. The Government accepted the report’s findings and took steps to implement the recommendations. The Government Insurance Market reform programme included the following:

The Joint Committee, in response to public concern about the issue of insurance, agreed on 29 January 2003 that it would consider arrangements put in place by the Department of Enterprise, Trade and Employment under the Government programme to reform the insurance market, especially with regard to the high cost of insurance to drivers and small businesses. The Joint Committee commenced a series of oral hearings from invited organisations and individuals on 19 June 2003. The Joint Committee had received 47 submissions in response to an advertisement placed in the Sunday newspapers. The Joint Committee’s first report was published in July 2003. In its report, the Joint Committee made 40 recommendations in relation to reforming the Irish insurance market.

In addition to meeting with those who complained about the high increases in insurance costs, the Joint Committee has met, each year, with each of the five major insurance companies. All of these meetings have been in public session and many have led to publicity about insurance costs and the actions being taken by the insurance companies and by Government to reduce these costs.

Since 2003, the following developments have taken place:

The Joint Committee made 87 recommendations prior to this report. Of these, 29 were made in the July 2006 Report on Road Safety. Most of these recommendations have not yet been accepted or rejected. Of the remaining 58 recommendations, only two have been rejected. However, 16 recommendations have yet to be implemented and the Joint Committee requests its successor Committee, in the 30th Oireachtas, to inquire into the implementation of these 16 recommendations during late 2008 or early 2009.

In this report the Joint Committee records many of the statements made by those giving evidence during 2006. The report makes six recommendations:

The Joint Committee has devoted a significant amount of its time to insurance reform due to the importance of the issue for consumers and businesses.

The Joint Committee is particularly grateful to all of those who gave evidence to it and provided many of the ideas on which the recommendations were based. In particular, the Joint Committee expresses its gratitude to the insurance companies for their cooperation. The Joint Committee is very pleased indeed that insurance costs have fallen so substantially between 2003 and now. The Joint Committee played its part in bringing about an extraordinary level of reforms in insurance and road safety in the Irish market. It was the agreement by members of the Joint Committee on the need for reforms that led to the speedy enactment of the legislation presented by Government to the Oireachtas.

The continuing fall in insurance premiums is an indication that the insurance market is now a competitive market. However, this has been achieved without a substantial new entrant. Nevertheless, the two Irish-owned companies, Quinn Direct and FBD, have provided significant competition to the other major companies operating in the Irish market.

The success of the insurance reform programme is a good example of what can be done when Government, an Oireachtas Joint Committee and industry work together to achieve results for the benefit of consumers and of business.

We examine in the report 15 general recommendations that have yet to be implemented. There is a lot more to be done. It is important that the reductions in insurance premiums should not delay or postpone reform of the market.

Furthermore, the success of two important reforms, the establishment of the PIAB and the enactment of the Civil Liability and Courts Act 2004 is by no means assured. It will take Government vigilance and a willingness to bring in amending legislation, if required, to ensure that insurance companies and policyholders continue to benefit from these changes.

The introduction and developments chapter records the developments that have taken place since the publication of the Third Report in January 2006. Among these developments were the publication, by the Minister for Justice, of the report on Ways of Reducing the Costs of Civil Litigation, the publication by the Competition Authority of its report on the legal professions and the publication of the Consumer Code by the Financial Regulator.

Important developments on road safety included the establishment of a Ministerial Committee to oversee road safety policy and the establishment of the Road Safety Authority.

The Joint Committee published a Report on Road Safety at the end of July 2006. This report contained 29 recommendations. While the recommendations have generally been welcomed, the Joint Committee is awaiting the publication of the Road Safety Strategy for the years 2007 to 2012 to ascertain whether or not they have been accepted.

In addition, the Joint Committee recommends that the Road Safety Authority require certain safety features to be fitted as standard to all vehicles imported after 31 December 2008. (Recommendation 59)

In general, insurance companies are making a significant contribution to road safety and to health and safety at work. However, it is always possible to do more and the Joint Committee has made a number of recommendations to the insurance companies that it believes will lead to further reductions in fatalities on the roads and at work.

The Joint Committee is concerned that the expert group, that it requested should be established to consider the level of awards in the Irish Courts compared with those in other countries, was not established during the last four years. The review of Irish awards, compared with those of other countries, is of critical importance if Irish insurance costs are to be competitive with those that exist elsewhere.

The Joint Committee obtained information from the Motor Insurance Bureau of Ireland. This showed that Ireland has the highest level of uninsured drivers in the EU.

The Joint Committee considers that it is possible to bring about further reductions in insurance premiums if the trend in the reduction of fatalities on the roads and in the workplace continues, and if the level of awards is reduced to comparable levels. In addition, actions to reduce the level of uninsured drivers and to implement the reports on the reduction of legal costs will be of considerable assistance in the further reduction of insurance premiums.

In addition, the Joint Committee is concerned that there is no agency clearly responsible for motor vehicle and driver records. It is essential that the Gardaí should have access to a database of motor vehicle and driver records if the level of uninsured drivers is to be reduced, and if road safety standards generally are to be improved. (Recommendation 64)

There are, however, 15 recommendations that should be implemented in the future and that need to be monitored by the Joint Committee of the 30th Oireachtas. Such monitoring can take place at any time, but it may be that a review in about two years’ time would be appropriate. The report lists the recommendations that are to be implemented in the future and comments on each of them.

In addition to the 15 recommendations, there are over 25 recommendations on road safety that were made in the July 2006 report that await implementation. These should also be reviewed in about two years.

The Joint Committee on Enterprise and Small Business published its First Interim Report on reforms to the insurance market in early August 2003, its Second Interim Report in July 2004, its Third Interim Report in January 2006 and a Road Safety Report in July 2006. This report is the Final Report of the Joint Committee in relation to insurance reform.

A list of the recommendations in all of the reports is given by category in Appendix B.

The Joint Committee appointed O’Reilly Consultants (218, Lower Kilmacud Road, Dublin 14) in April 2006 to provide further support during this series of oral hearings and to draft its Final Report on Insurance Reform.

The Joint Committee held a series of oral hearings with invited organisations, commencing in May 2006 and finishing in November 2006.

A list of the organisations and individuals who attended hearings of the Joint Committee is included in Appendix A.

Following each hearing a report was circulated to the Members of the Joint Committee. The transcripts of the hearings are published by the Editor of Debates. Video and tape recordings of the hearings are also available.

The Joint Committee commenced meeting witnesses for its Final Report on Insurance Reform in May 2006 and held three meetings with witnesses representing nine organisations during May and June. As part of its work, a delegation from the Joint Committee undertook a visit to the United States in June 2006 in relation to road safety. During its visit, the Joint Committee had ten meetings on different aspects of road safety in Chicago, Iowa, Maryland, Washington, Tennessee and New York.

In early July 2006, 11 people were killed in road crashes in one weekend; the number of fatalities on Irish roads (200) for the first six months of 2006 was higher by 18 than the number of fatalities in the first six months of 2005 and 2004. The media reported widespread public concern about road safety. For this reason, the Joint Committee decided that, instead of waiting until September to publish its Final Report on Insurance Reform, of which road safety would be a part, it should publish a report on its conclusions on road safety as soon as possible so that remedial actions could be taken by the appropriate authorities.

Motor insurance premiums partly reflect the level of motor vehicle collisions. One important aspect of reducing insurance premiums is to reduce the level of collisions and, in particular, the level of fatalities on Irish roads. In publishing its report, the Members of the Joint Committee were, however, primarily motivated by a desire to see a significant reduction in the number of fatalities and serious injuries on Irish roads.

The following developments have taken place since the Joint Committee published its January 2006 report.

The most important developments were in relation to:

Further information on each of these is set out below:

The Minister for Transport announced that a new high-level Government Road Safety Group was established, comprising:

The establishment of a body with specific responsibility for road safety is a significant development in relation to road safety in Ireland. The Road Safety Authority was established by Ministerial Order on 1 September 2006.

Among the functions of the Authority are:

The Road Traffic Act, 2006, makes provision for a number of road traffic issues including:

On 21 July 2006 the following came into force following a Ministerial Order:

The Minister for Transport introduced 31 new penalty point offences in April 2006. All offences having an effect on road safety are now subject to penalty points. A fixed-charge penalty point system (FCPS) commenced on 3 April 2006 and the Gardaí commenced issuing notices for a wide variety of offences.

The strength of the Garda Traffic Corps increased from 520 in January 2006 to 745 in November 2006. A further 455 members are to be allocated to the Corps, leading to a membership of 1,200 by 2008.

Following the Ministerial Order, the Garda Traffic Corps immediately commenced random breath testing. This had a dramatic effect on the number of fatalities during the remainder of 2006.

RTE’s Prime Time presented a programme in January 2007 on “boy racers”. The programme showed the extent of the problem and made a strong case for action by the Gardaí and Government if this problem is not to result in a further loss of life.

The Speed cameras will begin to operate during 2007.

Publication of, and action to implement, the Road Safety Strategy for 2007–2012.

Level of Fatalities

Year |

First Six Months |

Second Six Months |

Annual |

2001 |

185 |

226 |

411 |

2002 |

188 |

188 |

376 |

2003 |

172 |

163 |

335 |

2004 |

182 |

192 |

374 |

2005 |

182 |

215 |

397 |

2006 |

199 |

169 |

368 |

The numbers of fatalities in 2006 were the second lowest since 1965.

In addition, the fatalities in the second six months were very close to the level in the second six months of 2003, the lowest level since 1963.

As random breath testing did not commence until the relevant sections of the Road Traffic Act 2006 came into force on 21 July 2006, it would be reasonable to exclude July from the comparison.

Year |

August to December |

Change |

2001 |

185 |

|

2002 |

146 |

-39 |

2003 |

131 |

-15 |

2004 |

154 |

+23 |

2005 |

174 |

+20 |

2006 |

130 |

-44 |

The period August 2006 to December 2006 showed the lowest level of fatalities of any five months in the past six years and, possibly, since the early 1960s. If the average of August to September were to apply for a year, the number of fatalities would be 310, very close to the Road Safety Strategy target of 300. The improvement has continued in 2007 with 56 fatalities up to 9 March 2007 - an annual rate of 300.

A great deal has, therefore, been achieved. Undoubtedly, the introduction of random breath testing, which was made possible by the provision of a dedicated Traffic Corps, has been the principal reason for the reduction in fatalities but there were other reasons also:

the increased publicity given to road fatalities by the media.

Undoubtedly, the level of fatalities was lower in 2003, following the introduction of penalty points, than in 2006. The reduced level of fatalities lasted for the year from October 2002 to September 2003 when the number of fatalities was 315. An important question is whether the present reduced level will continue into the future.

It is almost certain that the most important measure to be continued for the foreseeable future is the random breath testing conducted by the Traffic Corps. If this continues for some years, it may be possible to bring about a historic and significant reduction in the level of fatalities on Irish roads. However, random breath testing alone will not be sufficient to continue the trend of the last six months. It is essential that there is:

This report was published on 27 July 2006. The report made 29 recommendations. These are given in Appendix B of this report.

Since the publication of the report the Joint Committee has met with the Minister for Transport, the Chief Executive of the Road Safety Authority, the Assistant Commissioner of An Garda Síochána, responsible for the Traffic Corps, and the Allianz Insurance Company. Reports of these meetings, in relation to road safety, are included in this chapter.

Comment on the Report by the Chief Executive of the Road Safety Authority

The Joint Committee’s Report on Road Safety was discussed by the Board of the Road Safety Authority at its September meeting. The Board was very welcoming of the report and spent 90 minutes discussing it. The report will provide an input to the Road Safety Strategy for the next three years, due to be published early in 2007.

Comment on the Report by the Assistant Commissioner

Assistant Commissioner Rock stated that he agreed with all of the recommendations in relation to young people, provisional licences, culture, etc., in the Joint Committee’s Report on Road Safety.

Comment by the Minister for Transport

‘I have noted the recommendations of the Joint Committee published in the Fourth Interim Report on Reforms to the Irish Insurance Market and Road Safety. I welcome all constructive suggestions which can lead to improved road safety and create a more robust motor insurance environment.’

Overview of Implementation of the Recommendations

A review of the 29 recommendations shows that some were implemented seven months later. It is understandable that not all of the recommendations were implemented in such a short time. The Joint Committee clearly wants to see these recommendations implemented so as to reduce the level of fatalities.

The Joint Committee notes the following developments:

Clearly, however, there are many more recommendations to be implemented.

In particular, the Joint Committee quotes from the Overview / Executive Summary of its Road Safety Report:

Road safety policy should assume that driver errors are inevitable. Roads should be engineered to ensure that driver errors do not result in fatalities; motor vehicles should be engineered to reduce the possibility of driver error and to reduce the likelihood of death where an error does occur.

The engineering of roads and of vehicles, in general, have not been sufficiently highlighted as reasons for road fatalities. We hope that the Road Safety Strategy for the years 2007 to 2009 will address these issues.

Among the findings of the Road Safety Report were:

Meeting with the Road Safety Authority and the Garda Traffic Corps on 8 November 2006

Mr Brett on behalf of the Road Safety Authority stated:

A KEY FACTS

B KEY MESSAGES

C BENEFITS

In his cost-benefit analysis of investing in road safety, Mr Peter Bacon, Economist, clearly demonstrated that for every €1 invested in road safety there would be an €8 return.

The benefits of reducing collisions, deaths and injuries are the:

The core objective of the Government’s Road Safety Strategy 2004–2006 was to reduce road deaths to no more than 300 by 2006. This is equivalent to 25 road deaths per month. In 2005, 396 people were killed on our roads, an average of 33 deaths a month.

For every death, which costs the State €2.2 million, there are eight serious injuries, each costing €300,0001 (2004 figures). In 2004 road deaths cost the state €1.2 billion.

The NRA tells us that the actions of road users are to blame for the carnage on our roads.

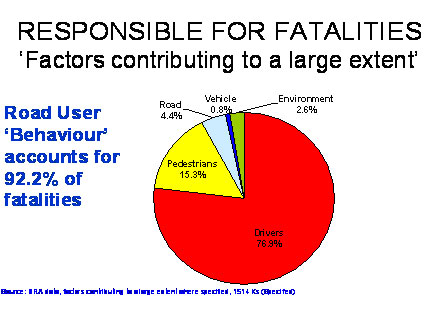

RESPONSIBLE FOR FATALITIES ‘Factors contributing to a large extent’

Road User Road ‘Behaviour’ accounts for 92.2% of fatalities

Source: NRA data, factors contributing to a large extent where specified, 1514 Ks (Specified)

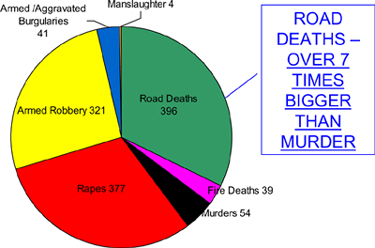

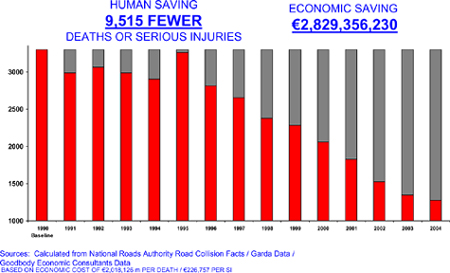

Road deaths in Ireland are over seven times greater than the number of persons murdered. Ireland’s Road Safety Strategy is working. Since 1990 there have been 9,515 fewer deaths and serious injuries. This represents an economic saving of €2,829,356,230.

Road Carnage In Perspective 2005

ROAD VICTIMS KILLED/SERIOUSLY INJURED 1990-2004

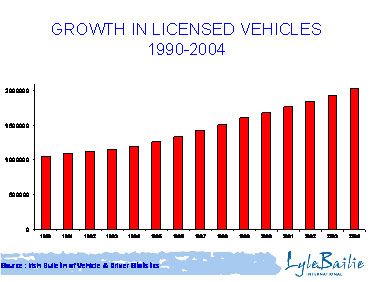

GROWTH IN LICENSED VEHICLES 1990-2004

This has been achieved in spite of a 100 per cent increase in the number of registered vehicles in the state since 1990.

What is happening on our roads is no accident. The main causes are:

As can be seen from Table 1, National Roads, while accounting for a mere 6 per cent of our road network, account for 48 per cent of all traffic volume and 40 per cent of fatal crashes. Regional and Local Roads represent 94 per cent of the network and account for 52 per cent of traffic volumes and 60 per cent of fatal collisions.

Table 1: Percentage of Collisions by Road Type (NRA)

Road Type |

Kms |

% of Network |

% Fatal Collisions |

% Traffic Volumes |

National Roads |

5,500 |

6% |

40% |

48% |

Regional and Local |

89,500 |

94% |

60% |

52% |

Total |

95,000 |

100% |

100% |

100% |

The Government is committed to reducing road deaths and injury through:

The successful reduction of road casualties throughout the EU has been achieved by focusing on the following enforcement activities:

The success of these actions in the EU can be clearly shown.

Penalty Points

During the period July to October 2006 there were 30 fewer deaths than during this period in 2005. This is a 21 per cent drop in road fatalities.

This is similar to the reduction of fatalities that took place in Switzerland as a result of random breath testing. However, it will be necessary to wait for three or four years to see the data arising from road accidents to determine definitively whether the drop has been caused by random breath testing.

The aim of the penalty points system is to save lives and reduce injuries on our roads. It is a voluntary system. To get penalty points a driver has to break the law.

On 3 April 2006 the administration of the penalty points system changed significantly. Most notably, the Garda fixed-charge payment system is now fully computerised and the Garda ‘Pulse’ system linked to the courts. There are now 35 offences attracting penalty points. This will undoubtedly enhance the efficiency of the system and hopefully its effectiveness in acting as a serious deterrent for drivers. Up to now, the system was administered on a manual basis.

In addition, an extra 240 Gardaí have joined the ranks of the Traffic Corps and an extra 28 Garda Traffic vehicles took to the roads in 2006. This increased the number of Gardaí in the Traffic Corps to 805 in 2006.

The Government has taken a decision to establish a public sector body, the Road Safety Authority (RSA), to take responsibility for a broad spectrum of road safety issues. The RSA will bring together key elements of road safety, including driver education, road safety promotion, driver testing, driver licensing, vehicle standards, research, etc. The RSA has a clear mandate to focus on this essential function.

The RSA was formally vested on 1 September 2006 and is now accountable for the delivery of the following statutory functions:

In addition, the RSA is responsible for producing and coordinating the Road Safety Strategy.

The RSA currently has a number of initiatives underway, including:

The Board of the Road Safety Authority will review the draft Road Safety Strategy for the three years from 2007–2012 with a view to publishing it in early 2007.

Assistant Commissioner Rock, speaking for An Garda Síochána, on 8 November 2006 stated the following:

‘Additional personnel have been allocated to the Traffic Corps throughout the year. The current strength stands at 745. By the end of the current year there will be an additional 60 personnel allocated to the Traffic Corps, bringing the total strength to 805.’

‘Garda enforcement activity is continuing to be enhanced through the allocation of additional personnel and resources. The fixed-charge system was extended significantly on 3 April 2006 and if errant motorists opt to pay fixed charges this should reduce the amount of time spent in court, thus enhancing our enforcement capability. Over 20,000 fixed-charge notices have been issued in respect of these new penalty point offences.

I hope that the long-term effect of the fixed-charge / penalty point system will be an improvement in the compliance culture and, as a consequence, a reduction in road collisions, fatalities and injuries.

In view of the contribution of speed to collisions on our roads, speed enforcement plays a significant part in our enforcement strategy. In 2005 the number of fixed-charge notices issued for speeding totalled 143,651. Provisional statistics indicate that number has already been exceeded in 2006, with almost 152,669 fixed-charge notices issued for speeding offences committed between the 1 January and 30 September 2006.

Seat belt detections have also increased this year. Provisional statistics for the first ten months of the year show that 20,070 fixed-charge notices have been issued compared to 18,084 for all of 2005.

The use of hand-held mobile phones while driving became a penalty point offence on 1 September 2006. Provisional statistics show a total of 2,525 fixed-charge notices issued for alleged offences committed up to the end of October.

The question of having a tiered penalty points system has been raised. The safety camera project will roll out next year and I believe this issue should be reviewed with the benefit of experience gained with the outsourcing of safety cameras.’

‘The legislation underpinning Mandatory Alcohol Testing (MAT) was introduced on 21 July 2006 and has been extremely helpful to the Garda organisation in tackling drink driving.

The general public has willingly accepted this legislation and this acceptance is witnessed on a daily basis by Garda personnel at MAT checkpoints. Provisional statistics indicate that over 100,000 breath tests have been conducted at MAT checkpoints.

There were 14,211 Detected Drink Driving Incidents recorded on PULSE from the 1 January 2006 to 31 October 2006 compared to 10,613 for the corresponding period in 2005, an increase of 34 per cent.

The following tables show how drink driving detections have increased significantly since the introduction of MAT checkpoints, when compared to the same period in 2005.

August 2005 |

August 2006 |

|

Detected Drink Driving |

976 |

1480 |

Incidents Recorded on |

||

PULSE |

(+51%) |

September 2005 |

September 2006 |

|

Detected Drink Driving |

935 |

1602 |

Incidents Recorded on |

||

PULSE |

(+71%) |

October 2005 |

October 2006 |

|

Detected Drink Driving |

1267 |

1816 |

Incidents Recorded on |

||

PULSE |

(+43%) |

In spite of our enforcement and the media / educational campaigns conducted with our partners in road safety, unfortunately the statistics overall indicate that a culture of drink driving still exists.’

‘When an arrest takes place for a drink driving offence there is a significant knock-on effect in terms of Garda hours lost to visible enforcement. A recent study of a sample of drink-driving detections showed the total Garda time spent processing a drink-driving case from arrest through to court hearing ranged from 40 to 100 hours. This included over 20 hours spent by the arresting Garda on file preparation, statements, notification of witnesses and court appearances.’

‘Between 1 January and 21 July 2006, the date the Mandatory Alcohol Testing (MAT) provisions came into effect, there were 20 more people killed on our roads when compared to the corresponding period in 2005. Between 1 January and today there have been 315 people killed on our roads, 14 less when compared to the corresponding period in 2005. The number of fatal collisions to date in 2006 is 25, less than for the corresponding period in 2005.

While the rate of fatal road traffic collisions has fallen significantly, it is too early to assert that there is a sustained trend.

Additional resources have been deployed to enforcement of drink-driving legislation, particularly at weekends during the hours of 12 a.m. to 8 a.m. These days and hours of the week have been selected because of the disproportionate level of road fatalities to traffic volumes at these times. I am also conscious that the incidence of drink driving detected tends to follow the incidence of fatal collisions during these hours.’

4 Speed Cameras

‘Work has commenced on the necessary procurement process to engage a service provider. Given the complexity of the process and in order to ensure adherence to EU and national procurement regulations, including the prescribed time periods, procurement support services required to facilitate the outsourcing process have been engaged.

The preparation of a call to the market for expressions of interest in tendering for the project is almost complete and will issue within a matter of days. Following the call for expressions of interest, a number of candidates will be awarded pre-qualification status and shortlisted to proceed to the next stage. A request for tender will be made to the shortlisted candidates, and the successful candidate will be selected on the basis of the tenders received. In parallel with this process, work is ongoing between An Garda Síochána and the National Roads Authority on identifying locations that have a speed-related collision history. If the plan runs to schedule the service provider will be operating safety cameras by the end of the second quarter of 2007.’

Assistant Commissioner Rock stated that uninsured vehicles confiscated in 2005 were 12,643. Since 1 July 2006, 444 foreign-owned vehicles had been seized.

The Chairman, Mr Donie Cassidy, T.D., asked for Mr Brett’s views on the Joint

Committee’s Report on Road Safety of July 2006. He also asked about:

The Chairman stated that he was very pleased that the numbers planned for the Garda Traffic Corps had been exceeded and that the Gardaí were implementing the random breath testing so successfully.

Mr Brett stated that the Authority had a staff of 309, of whom 275 had transferred from the Department of Transport and the balance from the NRA. In addition, the National Safety Council budget of €6.5 million had been taken over. Mr Brett was currently involved in discussions with the Department in relation to the estimates. Early indications were that a satisfactory budget for 2007 would be agreed.

On the Joint Committee’s Report on Road Safety, this had been discussed by the Board of the Road Safety Authority at its September meeting. The Board was very welcoming of the report and spent 90 minutes discussing it. The 29 recommendations were examined. The recommendations would be considered in the formulation of the new Road Safety Strategy.

On the question of testing for drugs, Mr Brett had met with the Irish Medical Organisation and the Health Service Executive (HSE). This was being watched very carefully. There was best practice in the UK in relation to this issue. It would be helpful for the HSE to issue similar advice. In Australia there was a saliva test for drugs, administered at road checks.

Assistant Commissioner Rock stated that he agreed with all of the recommendations in relation to young people, provisional licences, culture, etc., in the Joint Committee’s Report on Road Safety.

On “boy racers”, the Gardaí were increasing enforcement at weekends. There is a covert operation in place. A video has been prepared for concerts, etc., and for a school education programme.

At the time of giving his evidence, 105 persons between the ages of 16 and 25 had been killed on the roads. In Tipperary, a programme had been developed whereby Gardaí talked to boy racers. The suggestion was that this would be done nationally.

Deputy Callanan referred to the three Es (Education, Enforcement, Engineering). He believed that not enough had been done on education. The Gardaí should be going into colleges and schools and talking to 16–25-year-olds in an effort to move them away from a speeding and drink culture. The driver test should be part of the school curriculum. It was vital to get the driver testing backlog down to six weeks. All drivers should have training before starting to drive. Deputy Callanan also mentioned the road safety week then being launched in NUIG; he believed that we have gone a bit soft on engineering, that local authorities need to look at the state of the roads and that, in particular, hedges need to be cut – it was important to be able to see around bends. There were serious difficulties with some bridges and some bad stretches of road and nothing was being done in relation to them.

Senator O’Toole referred to the position in Sweden and France. He believed that we should change our driving to the correct side of the road. This would make it easier for cars coming from other countries. In France there were a significant number of speed cameras and motorists were advised of their presence about a half-a-mile before coming to them. There were two speed limits, a wet limit and a dry limit. There seems to be no difficulty with this. In France also there are no left-hand turns. The right-hand turns are the cause of a high number of accidents in Ireland. There was a difficulty with the merged lane when turning off at junctions. There was a lack of rest areas. There was an issue of fatigue between 2 p.m. and 4 p.m. He believed that the driver test was appalling. There was no overtaking manoeuvre and no motorway driving competence included in the test. Some element of licensing was needed for driver testers.

Mr Brett stated that he agreed with the issue of education. There would be a focus on the use of seat belts and professional driving in campaigns being organised by the RSA. He was concerned that they were not really getting at the third-level sector. He was working with the Department of Education and Science. It would be useful to have ten modules in Transition Year. He noted that 5 of the 29 recommendations in the Joint Committee Report referred to education and training. He also stated that the RSA was working with the Trade Unions and employer groups to improve the training of professional drivers. He believed it was necessary to provide for rest places.

He would like to see a review of speed limits throughout the country. He would enquire into the issue of merging lanes on motorways.

On driver testing, the RSA was very concerned and they would like to see that being dealt with as soon as possible.

Assistant Commissioner Rock stated that the Gardaí would design a sensible system in relation to the speed cameras to be deployed. The public would be educated and informed prior to the cameras coming into effect. There would be visible enforcement signs on marked sites. It was important to get the message across that this was not a revenue exercise. The Gardaí would have to have a rational basis for the selection of sites. Research indicates that speed is probably the number one cause of fatal crashes. In France the introduction of speed cameras had a dramatic effect on the reduction of fatalities.

Senator Coughlin asked how many speed cameras were in operation.

In response, Assistant Commissioner Rock stated that there were 20 sites with three cameras actually working at any one time. These sites were overt sites. In addition, the Gardaí had 490 handheld units. There were 6 vans in operation; these were being increased to 14. There may be 5,000 sites in the future. Gardaí are trying to find the areas that are best suited for this purpose.

Deputy Moynihan-Cronin referred to the education of children. She stated that the best way to do this was by persons of their own age. These should be brought in to speak to young people. She was concerned about foreign drivers, ‘Are they actually subject to the law in Ireland?’ In her own county of Kerry, there are many tourists and the issue is whether they are subject to the law. She wanted the RSA to work with local authorities in relation to cutting hedges. Many road signs are filthy; tourists have to stop in order to see what is on the sign. It was important that the RSA liaise with local authorities on these issues. In relation to seat belts on school buses, her information was that children were not using the seat belts because of bullying by their peers. There was a need to call on the operators to randomly check that the seat belts were being used and for inspectors to come on the buses. There was a need to teach people how to drive on roundabouts. Much of the driving on roundabouts was frightening.

Deputy Dempsey asked who decides on the location of speed limits. He stated that the theory test should become part of the curriculum in Transition Year and should also be part of the civics programme. He believed that the theory part of the test would be more interesting to pupils than much of what was being taught at present. He also referred to the difficulty associated with people taking prescription drugs, such as cough mixtures, which would be liable to show up as alcohol. He suggested that such persons should be allowed to have a letter from their doctor authorising them to take the products. He referred to boy racers taking over fields in his constituency and he asked whether County Councils should put in facilities for go-carting, etc.

Assistant Commissioner Rock stated that the Gardaí could not target foreign drivers. They must enforce the law in general. It was possible to bring foreign drivers to court. The issue arises in relation to driving licences issued in another jurisdiction that may have a different standard of driving. There was also a difficulty in relation to penalty points being attached to a driving licence where it was a foreign one. However, the Gardaí were generally not entitled to demand the nationality of a person and many foreign people have acquired Irish nationality. The question of penalty points is being addressed in relation to Northern Ireland cars. Many foreign drivers encountered by the Gardaí do not speak English. On policing in rural areas, he stated that an increase in the numbers of Gardaí may give an opportunity to increase such policing in the future. He stated that any person being required to take drugs, such as cough mixtures with an alcoholic base, can carry a letter from their doctor.

Mr Brett referred to the revamped education programmes and he agreed with the involvement of young people in explaining road safety to other young people. The RSA was targeting foreign drivers. Leaflets were now being produced in eleven languages, particularly Polish. The RSA had been in touch with the Polish Embassy. Suspensions could take place even where penalty points could not be applied. The RSA would shortly distribute a video in relation to conduct on roundabouts. Speed limits were a reserve function of the local authorities. On the question of education in secondary schools, the Board of the Authority is interested and this will be part of the next Road Safety Strategy. The RSA is trying to target young men. They had sponsored road rallying and had discussions with Motor Sport Ireland. Their purpose was to get the message across to spectators at these events. Their slogan was to ‘keep race in place’.

The Chairman stated that he was proud, as Chairman of the Joint Committee, that the Joint Committee had recommended the introduction of random breath testing which had brought about a reduction in fatalities. He stated that he very much appreciated the cooperation of the Gardaí and the RSA. He said, ‘Together we can make the roads safer.’

Minister Cullen stated as follows:

‘Thank you Chairman for the opportunity to discuss motor insurance and road safety matters. I have noted the recommendations of the Joint Committee published in the Fourth Interim Report on Reforms to the Irish Insurance Market and Road Safety. I welcome all constructive suggestions which can lead to improved road safety and create a more robust motor insurance environment.’

‘There are now in excess of 2.1 million vehicles registered in this State. The cost of motor insurance is therefore a cost on virtually every household and every business in the country.

The committee will be aware that the insurance industry in Ireland operates within a free and open market and one in which, under EU law, I can have no direct responsibility for setting motor insurance premiums. The provision of insurance cover is based on actuarial or statistical data, together with other underwriting or commercial factors, such as driver details, nature of cover required and type and use of vehicles.

I am pleased that the Government’s Insurance Reform Programme, initiated in 2002, has resulted in cheaper and increased availability of motor insurance. Between April 2003 and October 2006 overall motor insurance premiums have fallen by 31.5 per cent according to figures supplied by CSO.

There are various factors contributing to this reduction. The introduction of the Personal Injuries Assessment Board was a major step, as was the Civil Liability and Courts Act, which includes penalties for giving false or misleading evidence in personal injury cases. In addition, random breath testing, increased resources to the Garda Traffic Corps and the roll-out of the penalty points system are expected to deliver better driver behaviour and reduced frequency of traffic accidents. These initiatives are having a positive effect on motor insurance premiums and I am confident that they will continue to do so.

I have noted the recommendation of the committee in relation to my Department procuring an ‘Event Data Recorder’ or ‘Black Box’ system. There is already a proposal by the European Commission in relation to a similar type system called eCall, i.e. a system that would provide an electronic notification to the emergency services in the event of a crash. I understand that the case for these types of systems is unproven at European level. There are no common technical specifications developed and no standard operating procedures in place. I understand that many of the larger Member States have not yet committed to the eCall proposal and are in the process of studying the proposal in more detail in order to inform their policy on this issue.

My Department, like our European counterparts, is also studying the eCall proposal. As part of this study we are also reviewing the American-style data recorder approach similar to that proposed by the committee. The analysis will assist in understanding the potential implications and benefits of eCall and data recorders for Ireland with regard to road safety, the means by which the system will operate and the costs and benefits arising.

The main purpose of the study is to inform the Department’s future approach in this area. It is clear though that any approach that is proposed would need to be consistent with and interoperable with developments at the wider EU level.

In the committee’s report, the point was raised as to whether insurance companies could make a greater contribution to road safety. Several of the committee’s recommendations are specifically directed towards insurance companies to take steps in relation to improved road safety. I am aware of the contribution which the Insurance Federation of Ireland and individual insurance companies have made to road safety over many years, particularly in relation to funding for road safety programmes.

I am sure that the insurance industry will examine the recommendations made by the committee in a positive manner and in a manner that contributes to road safety. It is in the interests of all of us, legislators, insurance industry and citizens alike to seize every opportunity to improve road safety.’

‘The Road Safety Strategy 2004–2006 set an ambitious primary target of a 25 per cent reduction in road collision fatalities by the end of 2006 over the average annual number of fatalities in the 1998–2003 period. Achievement of the target would result in no more than 300 deaths yearly by the end of 2006. The planning horizon for the strategy was limited to three years and the realisation of many of the key central policy initiatives was planned for delivery at the end of the three-year period.

While the target of 300 has not been achieved, there is a considerable improvement in the number of road deaths over the 1997 figure of 472. The reduction to 396 deaths in 2005 has taken place against the background of a very significant increase in the number of cars and drivers on our roads during that eight-year period.

In an environment where pedestrians, cyclists, cars, motorcycles and very large buses and goods vehicles are mixed together in competing for space on our road network, risk is inevitable. Acknowledging that risk, and acting to minimise the potential for tragic incidents, is the immediate responsibility of all road users, but particularly drivers.

However, reducing the general level of risk is the particular challenge of Government and those agencies tasked with the promotion of road safety and the enforcement and application of traffic laws.

One of the lessons that we have learnt in recent years regarding road safety is that the best approach is to adopt a coordinated one involving all of those who can contribute to safer road travel. Such an approach should be based on a targeted programme of initiatives directed at the main contributing factors to collisions. In fact, such approaches are the bedrock of road safety policies in the best-performing countries throughout the world.

In that context, the Government has sought to bring a collective focus to road safety initiatives that are directed to the achievement of specified targets. That strategic approach to road safety works. It is likely that if we had not adopted a strategic approach from 1998 we would have seen the maintenance of the level of fatalities that had been prevalent throughout the 1990s, when the average annual number of road deaths was 442.

Achieving measurable progress is better realised where challenges are set. With that in mind, the new Road Safety Authority has commenced work on developing a new Road Safety Strategy for the period post-2006 and is currently carrying out a public consultation process on this matter.

Substantial progress has been made on a number of key policy initiatives, particularly in the area of changing driver behaviour and drink driving. There has been investment in new, improved and safer roads. A new system of metric speed limits has been introduced and the penalty points system has been extended.

Legislation has been enacted and commenced on a number of key policy measures, including the provision enabling roadside Mandatory Alcohol Testing (MAT), a ban on the use of hand-held mobile phones while driving, and the legislative provision supporting the operation of privately operated speed cameras. Since the commencement of MAT by the Gardaí, the number of road deaths and collisions has fallen dramatically. The Gardaí have been successfully operating MAT checkpoints since July 2006, with over 30,000 drivers being tested at MAT checkpoints each month. The increased deterrent effect is reflected in the fall in the number of deaths and in the collision rates since August 2006.

The establishment of the dedicated Traffic Corps last year by the Minister for Justice, Equality and Law Reform, having a distinct management structure under the command of an Assistant Commissioner, addresses a particular commitment given by the Government. The Corps, when it is fully staffed, will provide the basis for the achievement of the significant gains in road safety that emanate from consistent high levels of traffic law enforcement. By the end of 2008, 1,200 Gardaí will be deployed to the Traffic Corps which will be over twice the number currently engaged in traffic duties.’

‘The new Road Safety Authority was formally established on 1 September 2006. The Authority is a single agency with responsibility for a wide range of functions, which have a bearing on road safety, including driver licensing and testing, road safety advertising and education, road safety research and data collection and the regulation of driver instruction.’

‘A High Level Group on Road Safety, with representatives from various Government Departments and Agencies, has been working for some time to promote full cooperation on cross-cutting issues and an integrated approach in the development of the Road Safety Strategy and the monitoring and implementation of that strategy. In a signal, however, that road safety is now at the very top of the political agenda, the Government has replaced the official’s High Level Group with a Ministerial Committee on Road Safety chaired by the Minister for Transport and including the Ministers for Justice Equality and Law Reform, Finance, Health and Children, Education and Science and the Attorney General.’

The Chairman stated as follows:

The Minister responded as follows:

On the backlog in driver testing, the Minister had recruited new testers and introduced overtime for driver testers, contracting in, and outsourcing. The delay in obtaining a licence had been reduced from 62 to 28 weeks. In the Budget, a significant sum was allocated to further reduce the backlog. The reduction of the backlog would facilitate the introduction of the new licensing system.

Mr Ned O’Keeffe, T.D., asked about the significant level of investment in roads. This could reduce road accidents because of the much lower accident rate on motorways and dual carriageways. He drew the Minister’s attention to the issue of ‘tail-gaiting’. There was not sufficient publicity in relation to this issue. Regarding roundabouts, these tended to be too narrow and caused difficulties for motorists and particularly for lorries. They seemed to be much more spacious in the UK. Deputy O’Keeffe referred to the Mitchelstown bypass and some difficulties there. On signage, he could not understand why the link to the Cork road from the Portlaoise bypass had not yet been completed. It was necessary to introduce many unmarked cars in order to detect inappropriate driving. This was the real answer. Greater surveillance was needed. The unmarked cars should have local registration numbers. On random breath testing, the over-exercise of this was frightening and annoying a lot of people. The major cause of drink driving was nightclubs and late-night drinking. The drink culture had to be dealt with. He believed that nightclubs are a major cause of car accidents in the ages 16–27. He also referred to the question of boy racers and said that the Gardaí and the Minister were doing an excellent job. He wondered if our car accident statistics were good enough to show the real causes of accidents.

Deputy Moynihan-Cronin stated that the Monday morning stories of deaths on the roads were frightening. She referred to the large numbers of uninsured drivers. A large number of drivers do not display insurance discs.

She found that there was a car being operated in Ennis in her name. She had made a statement to the Gardaí in relation to this and she asked why it was possible to insure and tax a car in her name without reference to her. She wondered if this was happening to other people.

The cost of insurance for young people, at €230 per month, seemed to be very high indeed. She asked the Minister why there had been no new entrants to the motor insurance business and if there had been, if this would have resulted in lower costs. She further asked if the driving test, as we know it, will continue. In Killarney the driving testers had no permanent office. On random breath testing she complained that the present ‘roadside test’ showed positive and negative results only. Persons were being taken to the station after a ‘positive’ result and then found not to be over the limit. There was a question as to whether that person’s driving record showed that they had been arrested for drink driving. This was unacceptable.

Deputy Callanan stated that great work had been done in relation to dual carriageways and the road network. The benefits were now being experienced in the West of Ireland. It was good that the Minister had obtained money to cut the waiting list for driver testing. The waiting period had been far too long. He further stated that it was necessary to go down the educational route and to teach driver training in every school. The new criteria for the provisional licence should involve some training. He said that a car could be a lethal weapon. He asked about non-nationals being uninsured, ‘Are they good enough to drive on our roads?’ In relation to online motor taxation, he believed that the motor tax registration process should include a check with insurance companies as to whether or not the presented insurance policy details were valid. On road engineering, he believed that a survey should be undertaken to establish the black spots, bridges, etc, on country roads. These had not been tackled and could be fatal. There was also a problem with hedge trimming, which was done up to a few years ago. The Minister should write to local authorities in relation to this issue.

Minister Cullen stated that the improved roads / motorways / dual carriageways would result in a lower accident rate. On driver behaviour, the issue was partly that of education and the training of drivers. He criticised persons who ‘sat’ in the outer lane, which is an overtaking lane. The observance of this in other countries was much better. Education on this issue and others would form part of the new driver licensing regime. The Minister had introduced an additional 35 penalty point offences. These included issues such as yellow boxes, roundabouts, etc. On roundabouts, he proposed to raise the question with the National Roads Authority and to get serious answers to the issue of the width of roundabouts. On the standards in relation to roundabouts, he expected that a lot of the design was undertaken by local authorities in conjunction with the NRA. A new signage programme was being put in place on all roads. He was not familiar with the issue of the Cork exit on the Portlaoise bypass. On unmarked cars, it seemed that a proportion of Gardaí cars should be unmarked. On random breath testing, this should have a significant impact. While the Gardaí wished to maintain public confidence in this system, it was clear that drivers should respect the law relating to drink driving. Drivers in other countries pooled their driving and arranged transport so that the driver did not drink. On boy racers, he had seen horrific video footage. However, he pointed out that there are many very good young drivers. A cohort, however, did not think that the law applied to them. On uninsured drivers, it was estimated that these were about 5 per cent. Unfortunately, foreign-registered cars were not required to display insurance discs. This issue would be raised with the EU. Many EU countries do not require the insurance disc to be displayed. On the issue of motor tax registration, a study was being undertaken to coordinate the data files of the insurance companies with the national vehicle registration file. The IT structure was being put in place. The driver testing system would change and international best practice in this area would be examined. On drink driving and arrests, he noted the points that were made. He was aware that the old system had given a reading, and that the new roadside test was simply indicative, the real test being the blood test. He would look at the question of ensuring that a person who was arrested, but then found not to be over the limit, would not have a record of the arrest on their file. Discussions were taking place with the Road Safety Authority and the Department of Education in relation to a programme in schools. Transition Year instruction would be an ideal start. Essentially, this was a matter for the Department of Education. It was, however, more fundamental than just for Transition Year.

The Ministerial Committee on Road Safety had already discussed this issue. In relation to non-nationals, there was a mutual recognition of driving licences in Europe.

Senator Leyden referred to the figure of 5 per cent uninsured drivers and noted that this was 100,000 persons. This was resulting in the loss of an enormous amount of cash. There were no reasons why cars should not be seized. If uninsured, they should not be on the road. There should be a month-long campaign in relation to imported cars and others. He was very disappointed by the continual campaign against the PIAB. He noted recent remarks made in the Dáil.

He stated that he had had similar difficulties to those experienced by Deputy Moynihan-Cronin. A person had used his address for car tax and insurance. There had been a number of parking fines issued to Senator Leyden’s address. On making enquiries, he was told that there was no legal measure to prevent someone from using another person’s address. The Licensing Authority had no right to object to the address being given.

He referred to the difficulties on the Mullingar to Dublin road where there were no toilets or services of any kind. It was a big area. Surely the NRA should have provided facilities on this and other roads. He was glad that the cameras would not be a cash cow. In relation to speeding and other similar offences, there should be an appeal system. If somebody was being taken to hospital, there might be a need for a car to speed. He complained strongly about the practice of selling cars, boats and caravans on the side of the road. There was a car sale on every corner throughout the country. Should this be banned? He wanted to have the rules of the road made available in many languages. He believed that this was not yet available. The driving instructors should be able to give instructions in the Polish language. He stated that the road signage was totally inadequate and that very little progress had been made in reducing speed. There was a need for better coordination between the Department of Transport and local authorities in relation to the setting of speed limits.

Deputy McHugh referred to the standard of the roads. The physical standard was one thing. There were persons driving at 30 miles per hour on national roads, which frustrated other drivers who were then speeding to make up for lost time. On projects for Galway, while there was progress, it was necessary to do more. There were difficulties in Tuam and Claregalway. A new N17 was the answer but there would be a revolution in Galway if people had to wait for this to solve the traffic difficulties. He was disappointed that the work on the western rail corridor would not commence for about five years. He referred to the much faster development of rail projects in the Dublin area and believed that the West was still being left behind.

Deputy Breen referred to the question of drugs among young people. What messages were being communicated to tackle drivers’ use of drugs? There was a need for a course for young people in schools. He also requested that there should be refresher courses for more mature people. For example, elderly persons were often frightened to drive on roundabouts. He was concerned about the new bypass at Ennis where there were crash barriers in the centre of the road. On-coming cars were very close to one another.

Deputy M. J. Nolan noted there were over 2 million vehicles on the road. It was necessary to ensure an adequate level of resources for the RSA, the NRA and similar bodies. He would like to see an increase in the Garda Traffic Corps and believed that there would be public support for such an increase.

On the driving test, a constituent had travelled to Dublin for the test to be told by the tester that the test could not go ahead because of frost on the road. This was an extraordinary situation. The whole purpose of the testing was to equip persons to drive in difficult conditions. This constituent had to wait for three months before he could take the test again.

The Minister stated that all vehicles, including foreign-owned vehicles, could be impounded. This had been made possible by recent legislation. Prior to that, only vehicles registered in the State could be impounded. He agreed that cars should be taken from persons who were not insured. He would look at the issue of the address at which cars were registered.

He believed that one of the most bizarre decisions by the NRA was not to have rest areas. The NRA had reversed this policy and a new policy was nearing completion and would be announced shortly.

On cars being sold on the side of the road, he would come down on this as hard as possible. It was not only cars, but bikes, boats and caravans. He questioned the quality of these cars. He noted that the motor industry had invested substantially in showroom facilities. He was working with his Department to deal with this issue. The Road Safety Authority had published the basic rules of the road in ten languages. A new draft of the rules of the road had been on display and would be adopted shortly. These would be translated into all relevant languages. However, the question of not understanding the language did not justify breaking the law in relation to the four main causes of fatalities:

Regardless of where a person came from, these were offences. There should be no excuse that the rules of the road had not been translated into the language of the person driving the car.

All cars, including foreign cars, were subject to the NCT test. The speed limit issue was one of the most frustrating that he had to deal with. He had vested power in relation to speed limits on non-national roads to local authorities. However, the local authorities were not doing what was required. Some councils had done so but the vast majority had not. He would re-emphasise this point again. He noted that other political parties controlled most of the local authorities and he asked them to intervene on this issue.

In relation to Galway and the western rail corridor, this was high on his priority list. The road between Galway and Shannon and the Ennis bypass were important issues. The Ennis bypass would be opened the following Monday. The level of investment by the Government in infrastructure was unprecedented anywhere else in Europe. Five motorways were being constructed and there were numerous rail projects being undertaken. On the western rail corridor, he had adopted the proposals to provide for this corridor. This would be delivered as soon as possible, but Irish Rail had to strike a balance between this and other priorities.

Unfortunately, it was not possible at this time to have a roadside test for drug testing. In Australia there was a saliva test, but this only applied to amphetamines and cannabis. A lot of the difficulty related to prescribed drugs. The Medical Bureau of Road Safety was attempting to find a way to do a roadside test. However, if a Garda suspected that a person was incapable of driving because of having taken drugs, he/she could take him/her to the Garda station and have a blood test taken.

Crash barriers, as a safety feature, were a modern approach. He was conscious of the difficulties for older drivers.

Persons with provisional licences for 20 and 30 years were making representations that they should not have to do the test. Some persons were very worried. They had never had an accident. Nevertheless, the purpose of the new regulations was to improve the standard of driving.

On the Traffic Corps, the increase in numbers was a high priority. At the end of 2006 there would be 800. He was trying to push the programme forward. It was clear that enforcement helped enormously. He pointed out that the Traffic Corps was not the only resource available for detecting road offences; all Gardaí could be involved.

Generally, on driver testing, he found the present testing procedure bizarre. In some countries it was necessary to pass the test during each of the four seasons, where there was snow, during daylight and at night, etc. The system currently in existence was in danger of being discredited.

The Chairman stated that:

Minister Cullen responded as follows:

Road Safety Programme – Context

The Society of Actuaries in Ireland estimated that:

The views of motorists, established in the recent Irish Insurance Federation (IIF) ‘Road Safety Survey’, are alarming:

Road accident fatalities reduced substantially in August 2006. This coincided with the introduction of random breath testing supported by a vigorous enforcement campaign. This is clear evidence that effective enforcement is central to compliance with good driving behaviours. Until consistent, effective enforcement is achieved and sustained, the full benefits of any road safety programme will not be realised. Allianz commends and fully supports all road safety initiatives.

Since 2000 Allianz has contributed €7.5m to the IIF’s Road Safety campaigns.

However, Allianz is gravely concerned at major shortcomings:

Responses by Allianz to the Joint Committee’s Recommendations on Road Safety

Q16:Insurance companies should cooperate with the establishment of an electronic data recorder (EDR) system so as to improve their knowledge of the reasons for road accidents and to enable them to compete more effectively for motor insurance business in the future.

A16:Provided there are no civil liberty reasons or other ethical reasons for not doing so, Allianz is willing to cooperate with this proposal where there is an acceptance of proven benefits.

Q17:Insurance companies should give a discount on premiums to policyholders who voluntarily install an EDR.

A17:Already the no-claims discount system rewards claims-free driving, and any steps a driver takes to remain claims free, contributes to earning a bonus. Allianz will consider discounts in the context of evidence of improved risk.

Q18:Insurance companies should not grant insurance cover to a person who has not received driving instruction from a qualified driving instructor.

A18:Any insurer, under current legislation, could not refuse to quote a proposer who holds a valid driving licence, whether or not he/she has had instruction from a qualified instructor.

Q19:Insurance companies should structure their offers of insurance for persons up to the age of 25 to strongly encourage young persons to drive safely and avoid accidents.

A19:Allianz fully supports better prices for those with safe driving records. Also, Equality Legislation forbids us from favouring one age cohort over another.

Q20:Insurance companies should provide, or arrange to provide, driving instruction and advanced driving instruction for persons from 17 to 25 in order for the young persons to obtain a reduction in the cost of insurance.

A20:This is a substantial issue and would increase the cost of insurance. A course of ten one-hour driving lessons will cost at least €300. With motor premiums at €500/€600, there is no scope to fund driving instruction.

Q21:Insurance companies should offer persons who have been found to be driving in excess of the blood alcohol limit a choice of fitting an alcohol detector or a loading of their premium.

A21:A premium penalty cannot be evaded, whereas an alcohol detector will be fixed to a vehicle and the driver can bypass the system, by swapping cars, for example.

Q22:Insurance companies should give allowances that would encourage safety features in motor vehicles.

A22:Safety features on vehicles are already built into insurance prices.

Clearly, road safety is now high on the Government’s agenda. The success of the random breath testing and the other measures that have been introduced over the past year is very satisfying indeed.

The Joint Committee made 29 recommendations in its July 2006 report. Of these, only a small number have been fully implemented. However, the period since the publication of the July report has been short.

The Joint Committee looks forward to the publication by the Road Safety Authority of the Road Safety Strategy for the years 2007–2009. The Joint Committee hopes that the strategy will seek to bring about a significant further reduction in the number of fatalities on Irish roads and that it will address all of the many issues that were included in the Joint Committee’s Report of July 2006.

The Joint Committee in reviewing its Recommendation 8 (The Road Safety Authority should publish a programme to improve the safety standard and safety features of all imported vehicles over a period of three years) has decided to make specific recommendations for action.

The Joint Committee recommends that:

59. All imported vehicles should have the following fitted by 31 December 2008:

The Safety, Health and Welfare at Work Act, 2005, was enacted in July 2005 and came into force on 1 September 2005. The Act imposed a maximum fine on indictment for breaches of the health and safety laws of €3 million plus a term of imprisonment of up to two years. Company directors and managers may be held liable where they are found to have contributed to any offence.

In general, the Joint Committee’s recommendations in this area have been adopted.

During the course of his presentation, Mr Beegan stated the following:

– the raising of the level of general awareness

– the targeting of future workers and managers with information programmes through the national education training systems

– making relevant information easily available to people with responsibility for managing workplace safety

– identifying and assessing high-risk areas

– enforcing the occupational safety and health code with targeted and regular inspections of businesses.

– Insurance companies should reward good workplace health and safety practices by means of a verifiable and robust system to be worked out with industry. The Authority will be pleased to play a role in this process.